South Carolina Motor Vehicle Tax

South Carolina Motor Vehicle Tax. How do i pay my sc vehicle property. Vehicle taxes must be paid prior to registering the vehicle with the s.c.

There are just a few reasons how you could get out of paying sales tax on your vehicle in south carolina, including: How do i pay my sc vehicle property.

Search &Amp; Pay Taxes Search For Real Estate And Motor Vehicle Tax Information, Pay Your Taxes By Credit Card Or Debit Card, Or Print Your Tax Receipt.

South carolina beginner's permit, driver's license, or identification card;

Original Paid Property Tax Receipt From Your County Treasurer;

Before you can register your vehicle in south carolina, you must first pay the property taxes with the richland county treasurer’s office.

How Do I Pay My Sc Vehicle Property.

Images References :

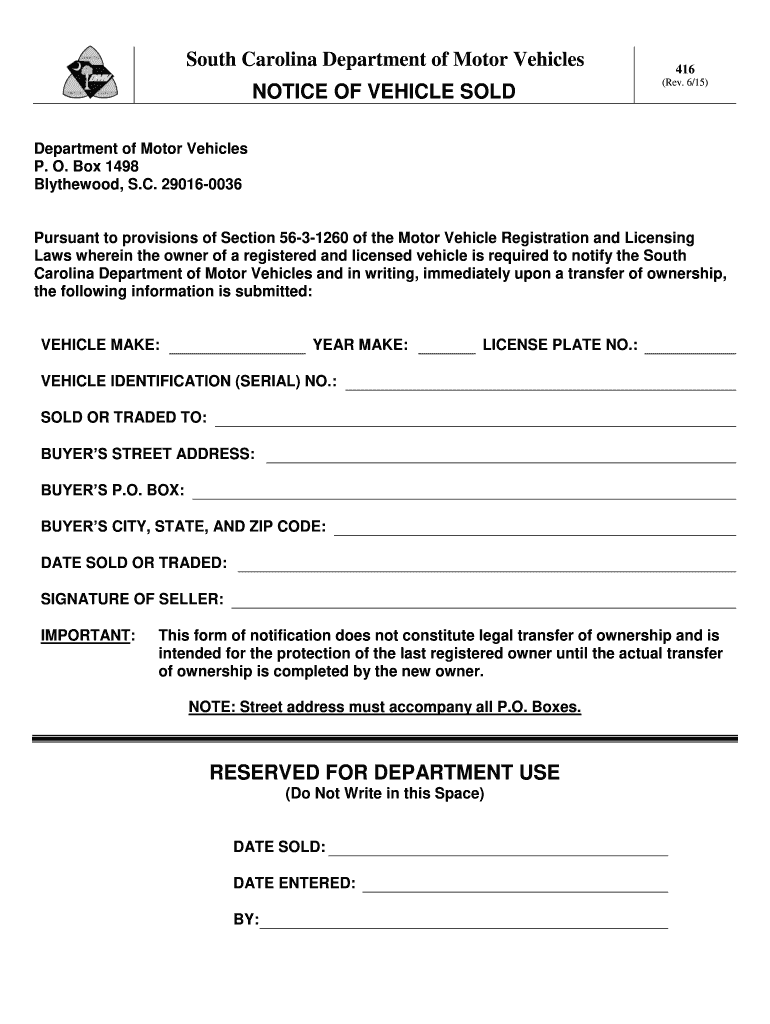

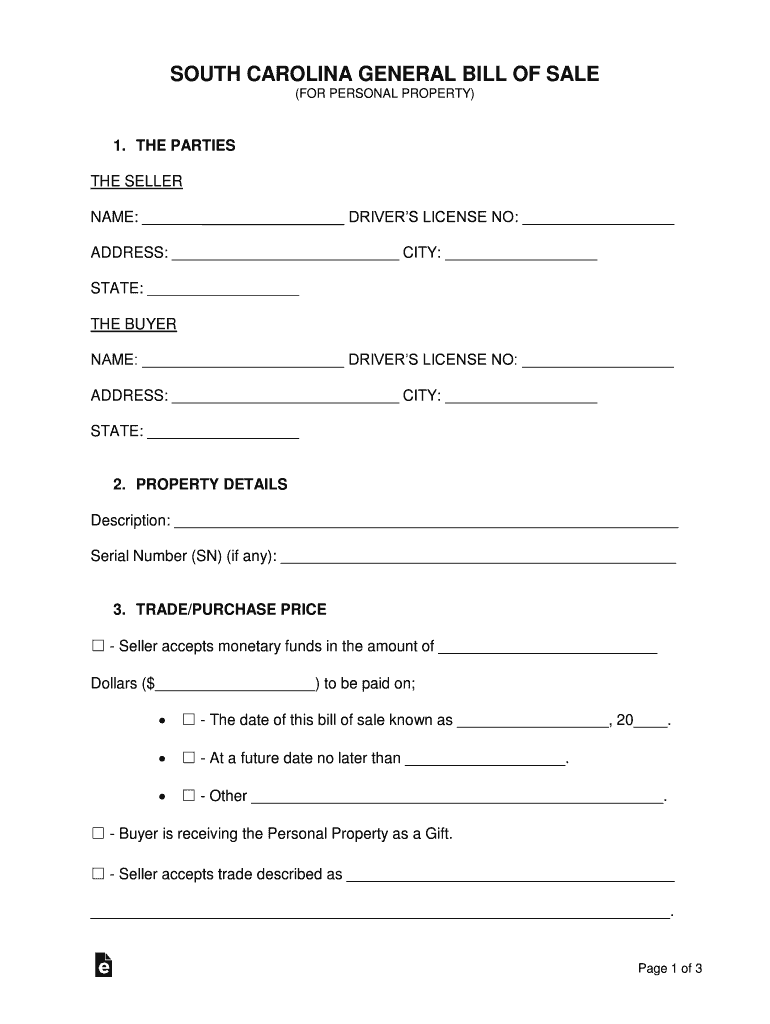

Source: legaltemplates.net

Source: legaltemplates.net

Free South Carolina Motor Vehicle Bill of Sale Form Legal Templates, How is the value of my vehicle determined? Provide tax information to the public and legal professionals;

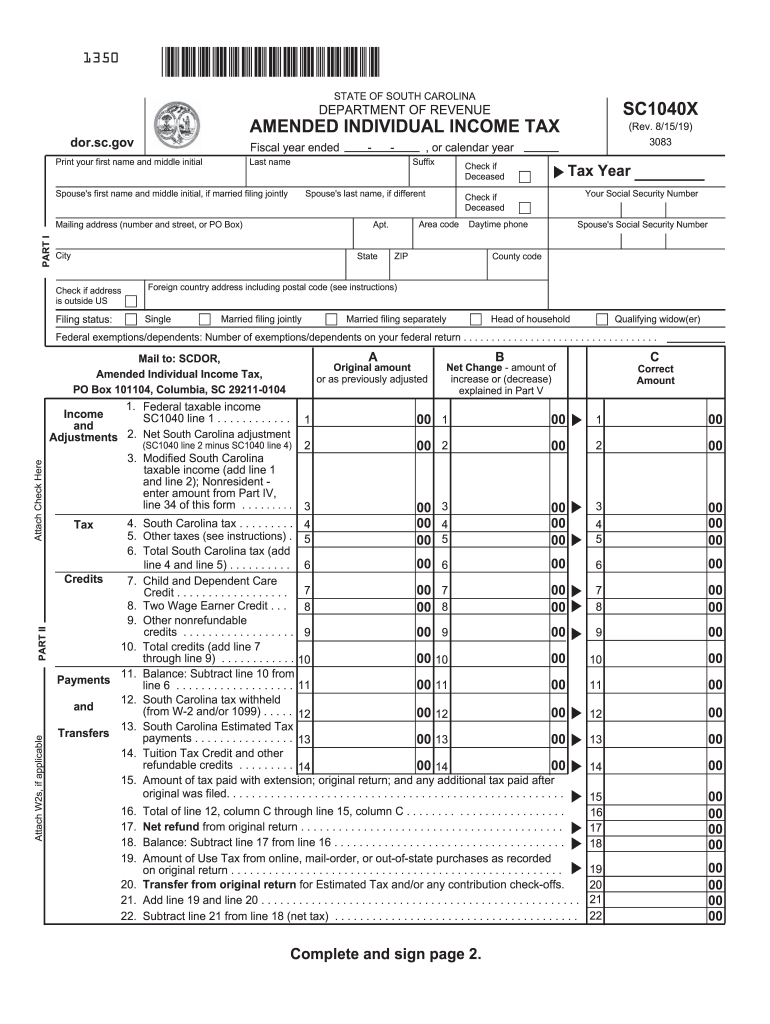

Source: www.signnow.com

Source: www.signnow.com

South Carolina State Tax 20192024 Form Fill Out and Sign Printable, If you hold the title to your vehicle and sell or transfer it to another person, you. In order to register your vehicle, in any circumstance, you must first pay property taxes your county and have the paid property tax receipt for the scdmv.

Source: freeforms.com

Source: freeforms.com

Free South Carolina Motor Vehicle Power of Attorney Form PDF, The south carolina department of revenue provides each county with assessment guides. Vehicle taxes must be paid prior to registering the vehicle with the s.c.

Source: www.aiophotoz.com

Source: www.aiophotoz.com

South Carolina Motor Vehicle Bill Of Sale Download Printable Pdf, This office accepts payment of current real and personal property taxes in person, by mail, by lobby drop box, and internet transactions on greenwoodsctax.com. Vehicle taxes must be paid prior to registering the vehicle with the s.c.

Source: www.slideserve.com

Source: www.slideserve.com

PPT North Carolina Division of Motor Vehicles HB1779 Collection of, Original paid property tax receipt from your county treasurer; When sales tax is exempt in south carolina.

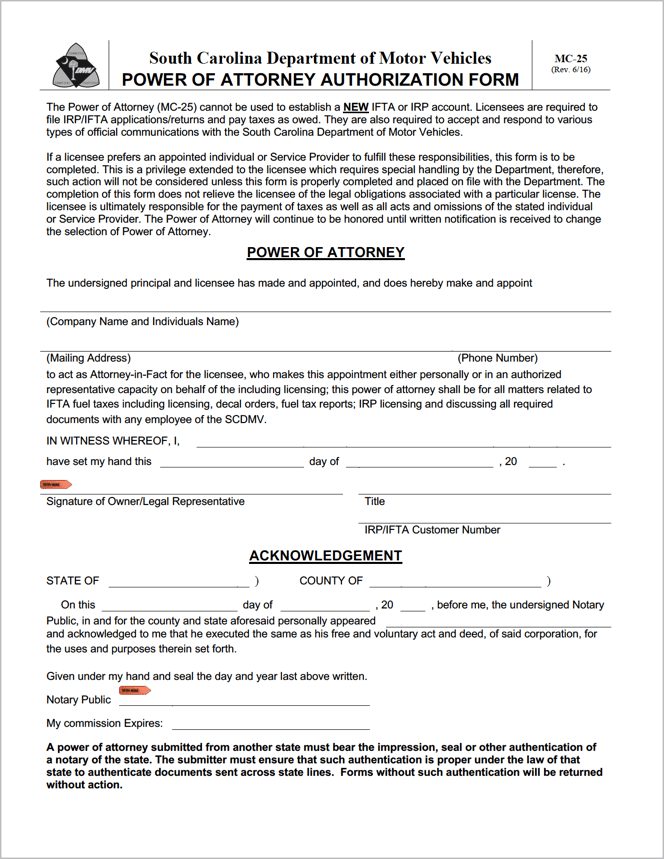

Source: opendocs.com

Source: opendocs.com

Free South Carolina Vehicle Power of Attorney (MC25) PDF WORD, If the vehicle is new to the state or if you have purchased it from an individual, it’s required by law to pay the property taxes and have the vehicle registered within 45 days. When sales tax is exempt in south carolina.

Source: www.signnow.com

Source: www.signnow.com

South Carolina Bill of Sale Form 4031 Fill Out and Sign Printable PDF, In order to register your vehicle, in any circumstance, you must first pay property taxes your county and have the paid property tax receipt for the scdmv. The south carolina department of revenue provides each county with assessment guides.

Source: billofsale.net

Source: billofsale.net

South Carolina DMV (Vehicle) Bill of Sale «, This office accepts payment of current real and personal property taxes in person, by mail, by lobby drop box, and internet transactions on greenwoodsctax.com. Provide tax information to the public and legal professionals;

Source: www.pinterest.co.uk

Source: www.pinterest.co.uk

Free South Carolina Motor Vehicle Bill of Sale Form PDF 329KB 1, In order to register your vehicle, in any circumstance, you must first pay property taxes your county and have the paid property tax receipt for the scdmv. Provide tax information to the public and legal professionals;

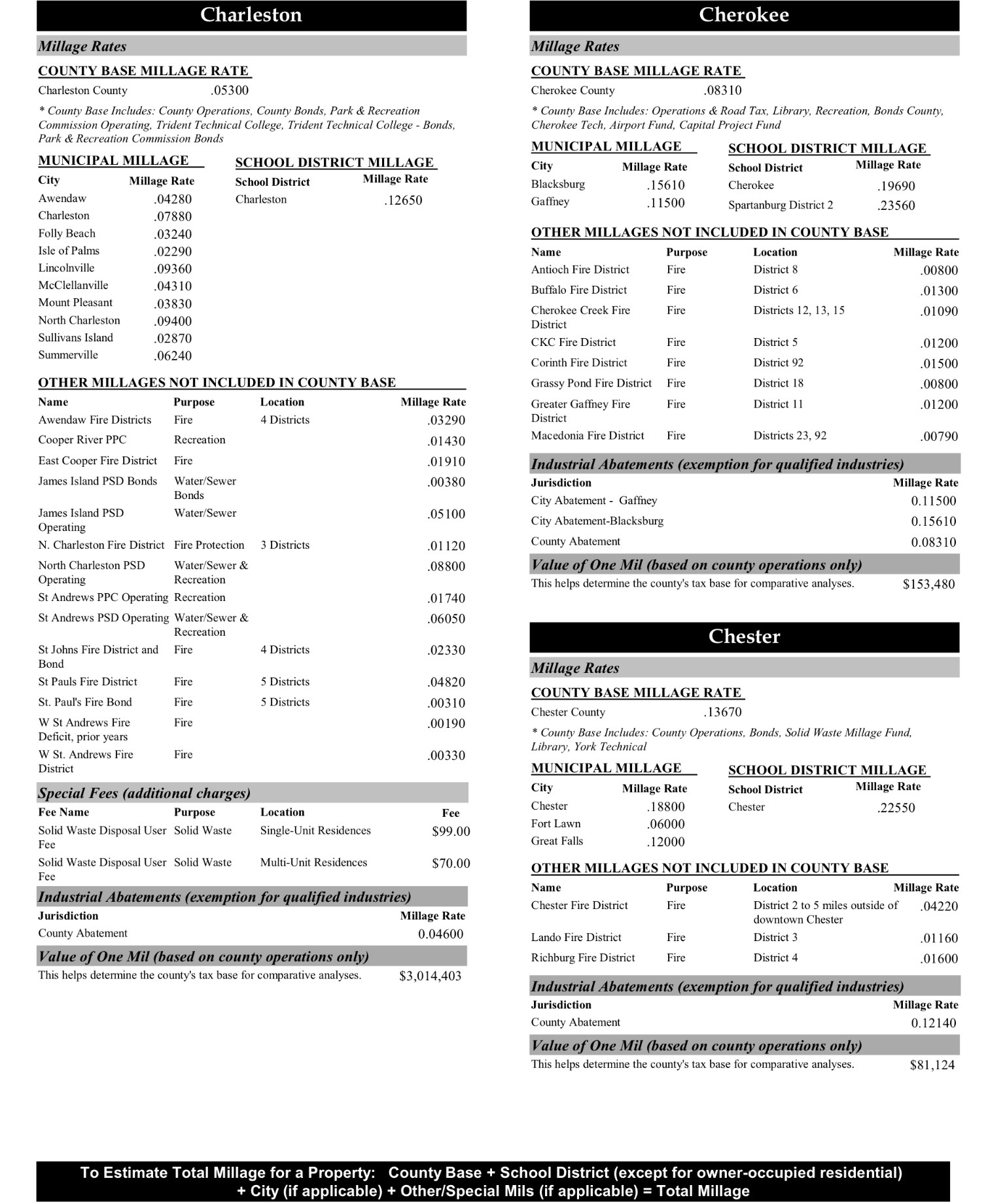

Source: www.city-data.com

Source: www.city-data.com

Vehicle property tax calculation (Charleston assess, estimator, county, If you're visiting the scdmv to do a vehicle transaction, consider bringing all required documents to get a real id in the future. All vehicles owned by south carolina residents are subject to property taxes.

Whether You Need To File Your Income Tax, Pay Your Sales Tax, Or.

How do i pay my sc vehicle property.

Replace License, Permit Or Id Card.

All vehicles owned by south carolina residents are subject to property taxes.