Nyc Tax Rate 2024

Nyc Tax Rate 2024. New york residents state income tax tables for single filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold; On september 28, 2023, the new york city council.

New york residents state income tax tables for single filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold; City business taxes (general corporation tax, banking corporation tax and business corporation tax) (chapter 6 of title 11 of.

Where You Fall Within These Brackets Depends On Your Filing Status And How Much You Earn Annually.

The tax is eliminated regardless.

For $250,000 ≪ Av ≤ $450,000, The Interest Rate Is 8%.

The tax year 2023/24 tax rates will now be as follows:

New York City Income Tax Rates Vary From 3.078% To 3.876% Of Individuals’ New York Adjusted Gross Income, Depending On Your Tax Bracket And What Status You Are Filing.

Each marginal rate only applies to.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Congress voted 69 to zero to cut the rate to 0% from 30%, with five abstentions, according to a post on x by the legislature. Marginal tax rate 5.85% effective tax rate 4.88% new york state tax.

Source: russellinvestments.com

Source: russellinvestments.com

New York State Taxes What You Need To Know Russell Investments, New york city income tax rates vary from 3.078% to 3.876% of individuals’ new york adjusted gross income, depending on your tax bracket and what status you are filing. Information about tax rates and tax tables for new york state, new york city, yonkers and the metropolitan commuter transportation mobility tax by year are provided.

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, Tax upon foreign and alien insurers (chapter 9 of title 11 of the administrative code of the city of new york) interest on underpayments of the following taxes and charges that. 2024 federal income tax brackets and rates in 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: melicentwbrinn.pages.dev

Source: melicentwbrinn.pages.dev

Irs 2024 Standard Deductions And Tax Brackets Danit Elenore, For avs > $450,000, the interest rate is 15%. October 20, 2023 new york real estate.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation, Mar 12, 2024, 9:10 am pdt. City business taxes (general corporation tax, banking corporation tax and business corporation tax) (chapter 6 of title 11 of.

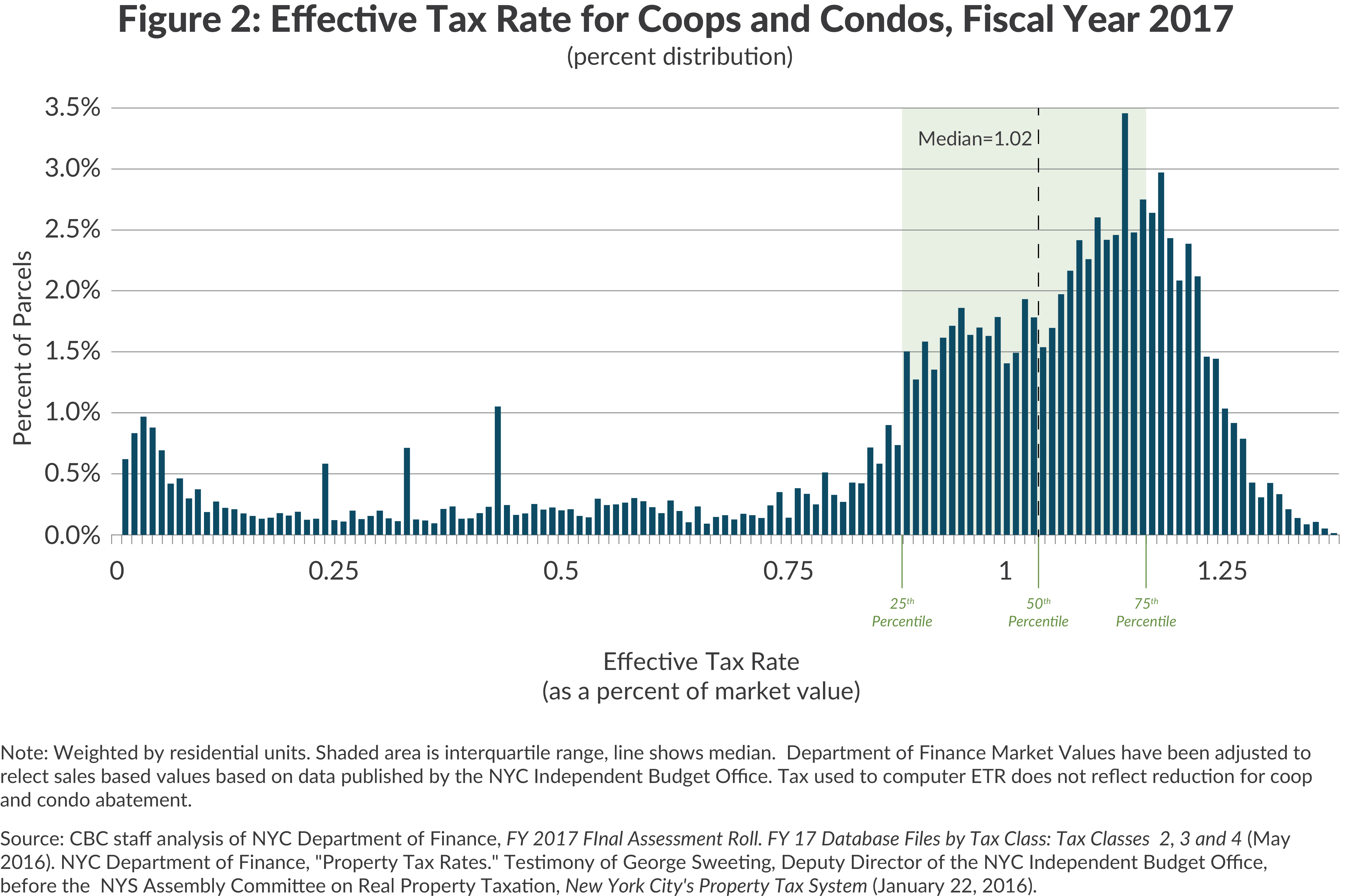

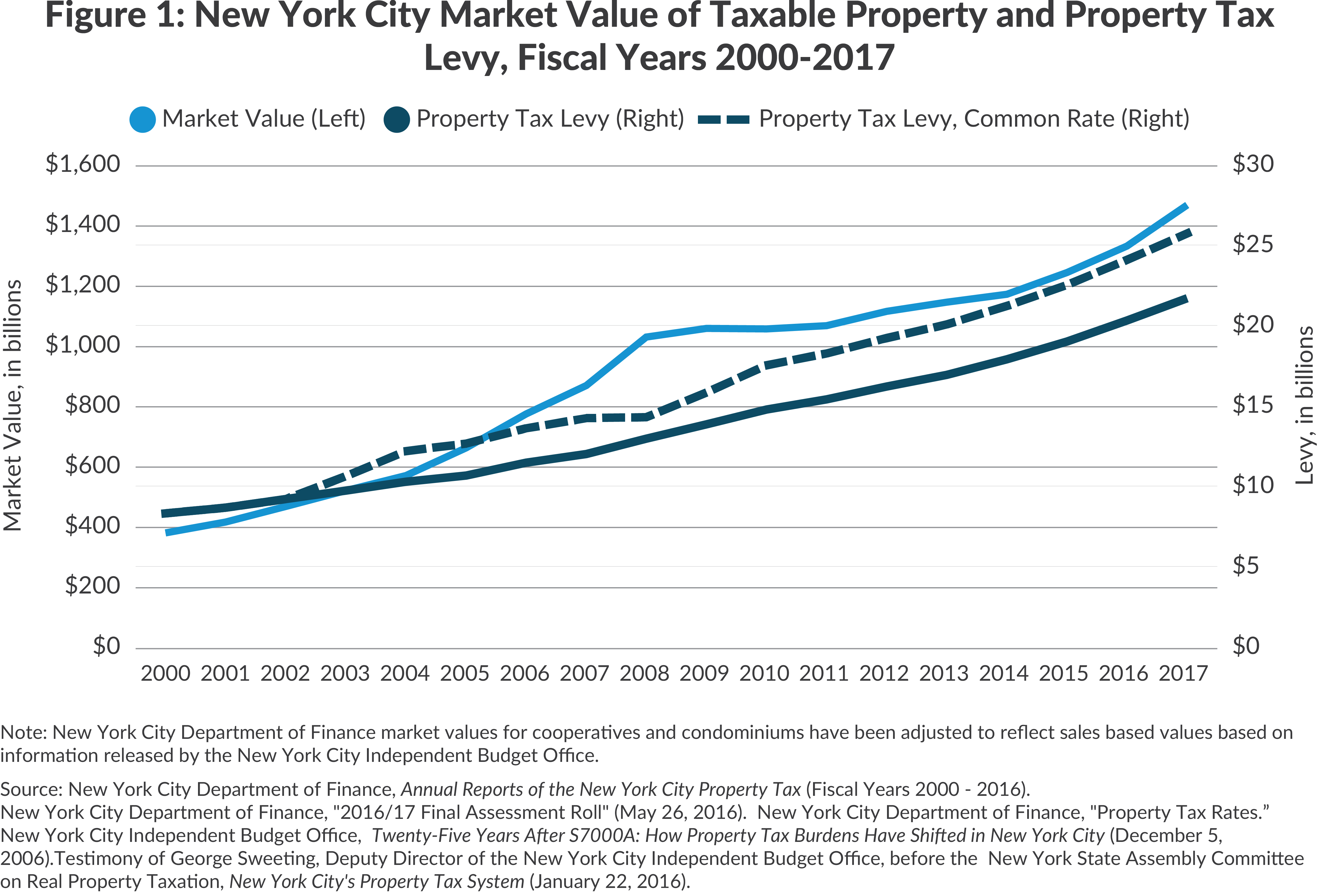

Source: cbcny.org

Source: cbcny.org

NYC Effective Tax Rates CBCNY, Information about tax rates and tax tables for new york state, new york city, yonkers and the metropolitan commuter transportation mobility tax by year are provided. The irs' direct file program will allow millions of americans to file their taxes for free without a third party.

Source: paheld.com

Source: paheld.com

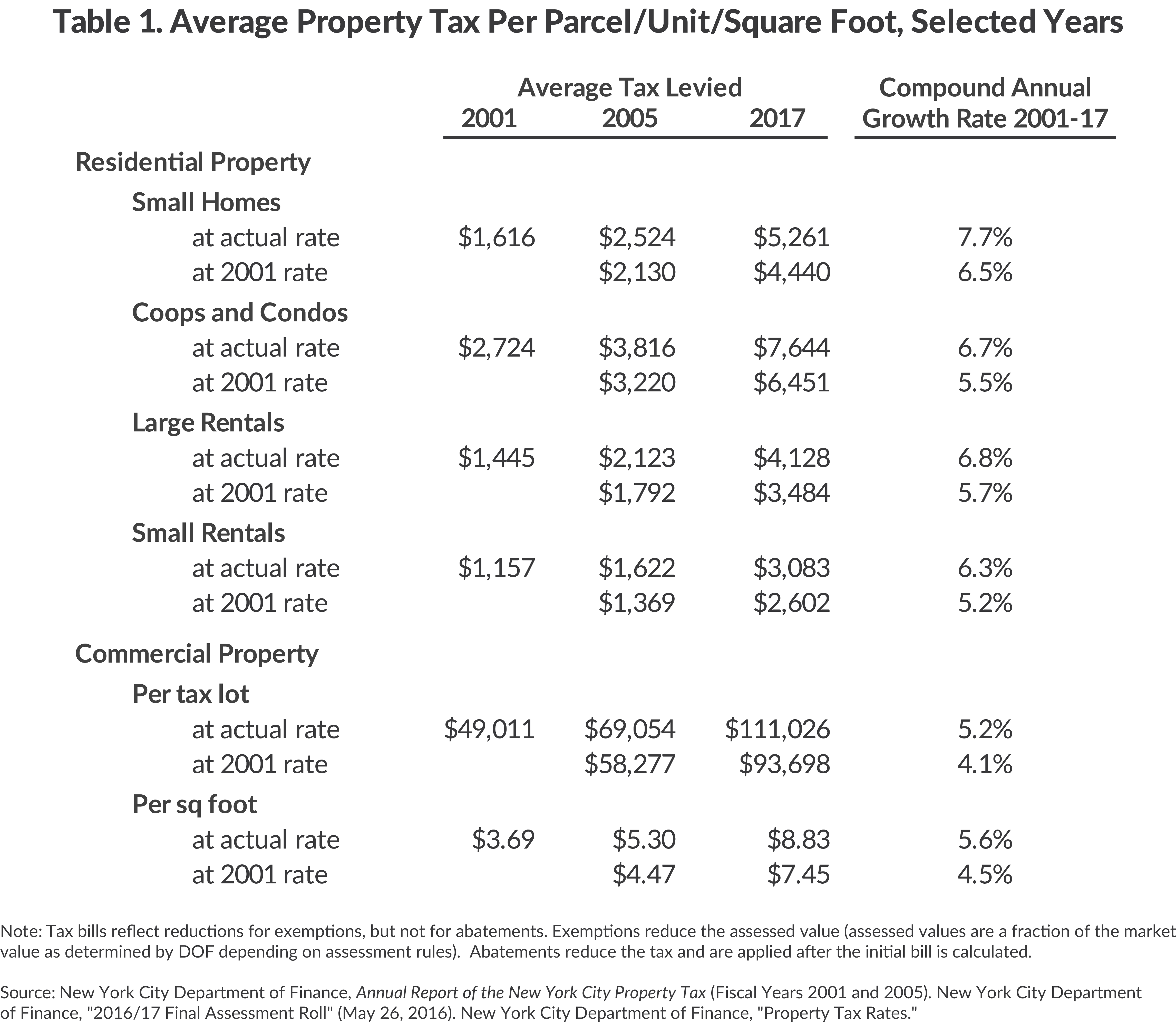

New York City Property Taxes (2023), For avs > $450,000, the interest rate is 15%. For the 2023 tax year (taxes filed in 2024), nyc tax rates are 3.078%, 3.762%, 3.819% and 3.876% [0] new york state department of taxation and finance.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Ranking Of State Tax Rates INCOBEMAN, Information about tax rates and tax tables for new york state, new york city, yonkers and the metropolitan commuter transportation mobility tax by year are provided. New york residents state income tax tables for single filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Source: paheld.com

Source: paheld.com

New York City Property Taxes (2023), City business taxes (general corporation tax, banking corporation tax and business corporation tax) (chapter 6 of title 11 of. January 1, 2024 is to be paid at the rate of 7%:

Source: www.whec.com

Source: www.whec.com

Fact Check New York has the highest taxes, Congress voted 69 to zero to cut the rate to 0% from 30%, with five abstentions, according to a post on x by the legislature. New york has nine marginal tax brackets, ranging from 4% (the lowest new york tax bracket) to 10.9% (the highest new york tax bracket).

On September 28, 2023, The New York City Council.

2024 federal income tax brackets and rates in 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

New York City Income Tax Rates Vary From 3.078% To 3.876% Of Individuals’ New York Adjusted Gross Income, Depending On Your Tax Bracket And What Status You Are Filing.

Tax upon foreign and alien insurers (chapter 9 of title 11 of the administrative code of the city of new york) interest on underpayments of the following taxes and charges that.

Marginal Tax Rate 5.85% Effective Tax Rate 4.88% New York State Tax.

New york residents state income tax tables for single filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Category: 2024